REGISTRATION GUIDELINE

| Physical participation only. Please register in advance to reserve your seat.

Images from the event may be used for AmCham Vietnam HCMC & Danang’s post-event information, marketing and promotional purposes. The personal information provided to us will only be used for event registration and administration. By registering for this event, you agree and consent to the above. |

Event Description

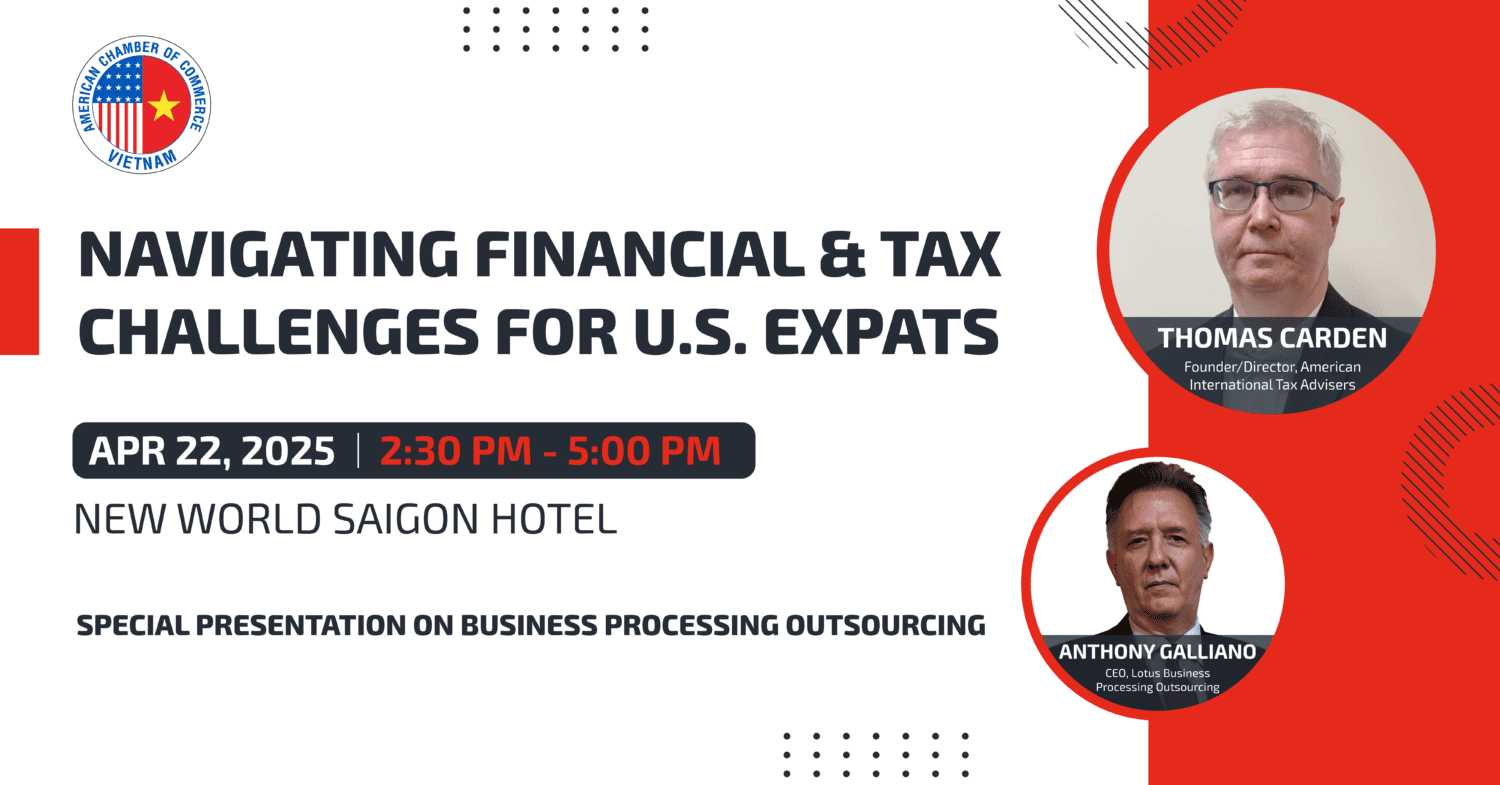

American International Tax Advisers (AIT) is one of Asia’s best U.S. tax firm. AIT will focus on tax for U.S. expatriates and businesses, covering tax planning, minimization of tax paying, optimizing tax efficiency, and return preparation. The presentations will include everything from filing normal U.S. returns to more complex cases. Topics will also encompass W-8Ben and W-8Ben-E forms, Foreign Bank Account Reports (FBAR), Foreign Earned Income Exclusion, and retirement considerations for expiates overseas. There will be a session on wealth management and financial planning for U.S. expatriates. There will be short presentation on Business Processing Outsourcing from Lotus BPO,.

| 2:30 PM | Check-in for guests |

| 3:00 PM | Welcome remarks |

| 3:05 PM | Thomas Carden:

Anthony Galliano:

|

| 5:00 PM | Event ends |

| AmCham Members: VND 650,000 | Non-members: VND 800,000 |

| Reservations/cancellations must be received by 24 hours before the event, and must be made on-line or by email. We are unable to accept reservations/cancellations by telephone. |

Anthony Galliano Anthony Galliano

CEO, Lotus Business Processing Outsourcing Anthony is Group CEO of CIM Holdings, Chief Executive Office of Cambodian Investment Management, and Chairman of Cambodian Investment Management Audit Services, Affinity Star Insurance Broker, Phnom Penh BG Serviced Office, Premium Human Resources, Cambodian Investment Management Insurance Agent, Dynamo Innovative Digital Advertising. He is also the former President of the American Chamber of Commerce in Cambodia, Vice-President of the American-Lao Business Association, Treasurer of the Cambodian Restaurant Association, Director of the Cambodian Insurance Brokers Association,and Board of Director on Digital Classified Group, Tanncam Investment Pte, Backyard Hospitality, Payscout (U.S.A.) Star Insurance Sole (Laos), Fazwaz (Cambodia), and Regiotel (Cambodia). The primary businesses of the group are Corporate Finance, Venture Capital, Accounting, Payroll, Tax, Audit, Human Resources, Insurance Broker, Serviced Offices, and Media. |

Thomas Carden Thomas Carden

Founder/Director, American International Tax Advisers Thomas Carden is the founder/director of American International Tax Advisers. He is enrolled to practice before the Internal Revenue Service. He has over 25 years of Tax and Financial Industry experience. He started in 1995 in his father’s CPA firm and progressed to being the international expatriate tax specialists for a surviving remnant of Arthur Anderson. He has a Bachelors in Global Business Management from the University of Phoenix and a Juris Science Masters in International Tax and Financial Service Law. Thomas is a noted Lecturer, Author, and Academic on International Tax and business issues especially where there is a nexus with the United States. While working in both the Tax and Financial Services for more than 25 years he has built up an extensive knowledge of the international business issues that have allowed him to work with, and solve complex issues for individuals, companies and financial institutions. He is the rare academic with a practical knowledge of the most complex international business issues. He specializes in helping small companies grow globally through efficient business structuring. He is often asked to be a featured speaker at events educating international professional groups on the challenges and opportunities facing International Tax and Financial Services. He also specializes in tax treaties which differ for every country. He has been a guest lecturer at BBA International Program, Faculty of Commerce and Accountancy, Chulalongkorn University and Business School of Siam University. |